Gold shines, but does it make your portfolio shine too? Unfortunately, not always. This somehow contradicts to the most recent recommendation of Mr. Ray Dalio, the founder of investment firm Bridgewater Associates, the world's largest hedge fund. Mr. Dalio advises having 5-10% of ones assets in gold as a hedge and adds: “If you do have an excellent analysis of why you shouldn’t have such an allocation to gold, we’d appreciate you sharing it with us”. Well, we took the challenge, did a simple comparative analysis and have some suggestions for replacement of gold as an alternative for “safe heaven” assets.

Gold is considered to be a “safe haven” asset for years already and is broadly used as a risk diversifier. But does such diversification always help? Since the middle of 2009, gold has been underperforming both S&P500 and Credit Suisse Hedge Fund Index while having even higher volatility.

If we take the longer period, say the last 24 years (since 1994), the results are as follows: annualized return of Gold is 5,15%, S&P500 – 7,12%, CSHFI – 7,66%, while standard deviation 12,75%, 14,54% and 6,87% respectively.

Are emerging asset classes a better choice?

In search for the other alternatives we purposely skipped such asset classes as real estate or private equity and looked for the new emerging ones, still widely uncovered by the majority of investors however enjoying billions of market capitalization already. The most important factors for us to pick the new alternatives to replace gold were their low (or no) correlation to traditional capital markets and exposure to completely different risks. Isn’t it a definition of the perfect hedge?

Let’s take a look at life settlements and crypto currencies. The market capitalization of life settlements is around $2 billion (based on data provided by Life Insurance Settlement Association) while crypto currencies already enjoy $56 billion market cap. Both figures might look miserable compared to gold’s market capitalization of $7.5 trillion, but both assets classes got an increasing interest over the last few years and the trend is expected to prevail.

Thus, we have replaced gold with the carefully selected life settlements fund – as still there are no common life settlements indexes we took it as a proxy for the whole industry – managing roughly $700 million portfolio and being one of our clients’ top selection and bitcoin to represent growing popularity of crypto currencies. Both of them demonstrated consistently high and considerably higher returns over the same period compared to gold and in the case of life settlements – with much lower volatility.

Life settlements fund has started its activities only in 2009 thus we are unable to track for the longer period of time including equity bear market periods, however, knowing completely different set of risks – longevity and mortality – with a pretty high level of probability we may conclude we would be able to achieve even better results.

With the recent 4x spike in bitcoin price over the last 5 months and more than 100% surge in just a month you can imagine the price graphs and how it is incomparable with S&P500 or broad hedge fund index.

Let’s now turn to the most intriguing part of the analysis and let's simulate what would happen if you enhance a traditionally balanced 40/60 portfolio portfolio by allocating 20% of it to gold. The benefit of diversification is clear as standard deviation drops by 1,55 p.p., however, at the expense of performance as annualized return also shrinks.

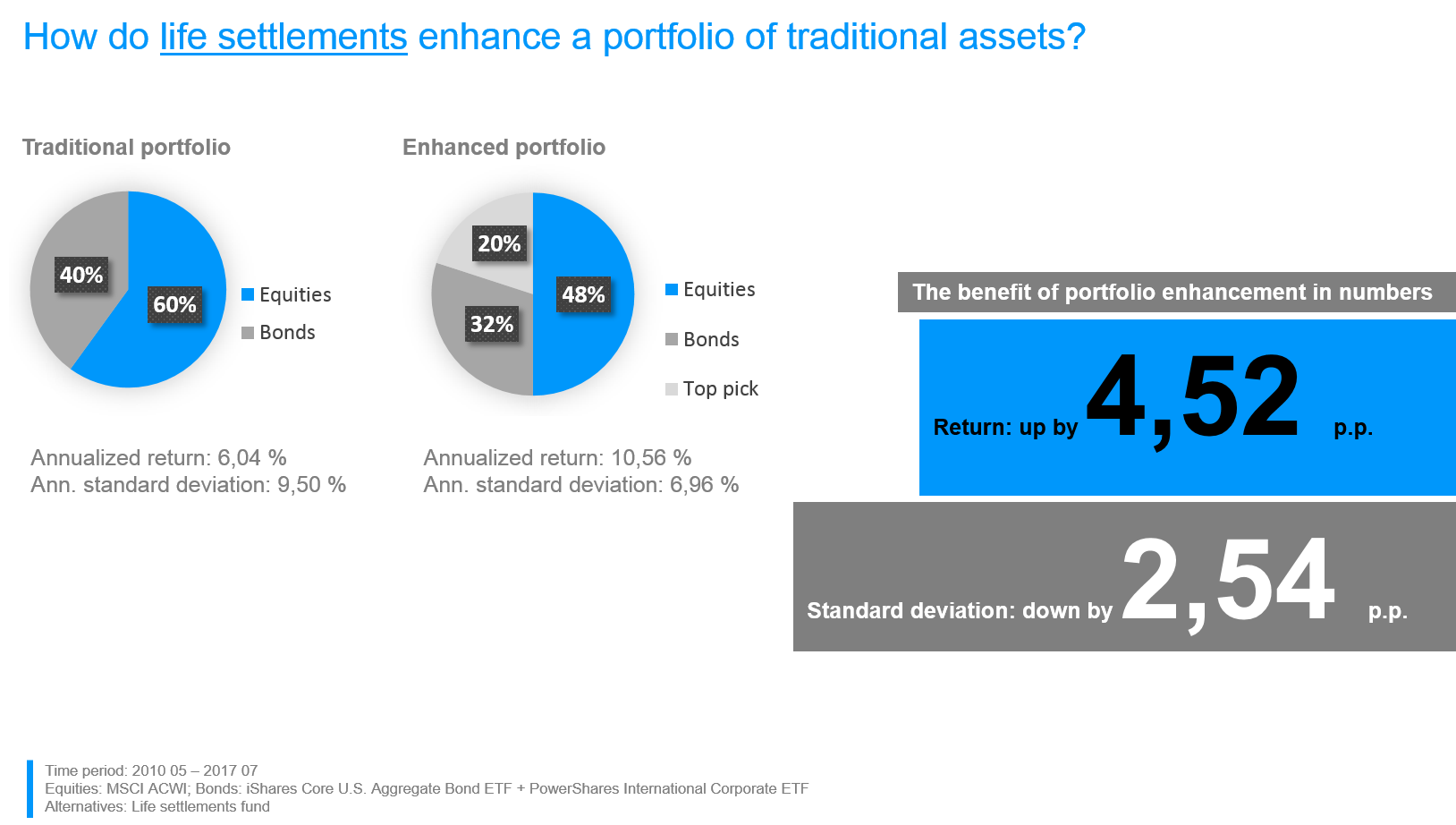

Now let’s do exactly the same with the other alternative investments. The results is breath taking: you may significantly enhance your performance by increasing the return and decreasing the volatility (or the risk, if you like). Here is an example of how our selected life settlements fund enhances a portfolio of traditional assets over the last 7 years:

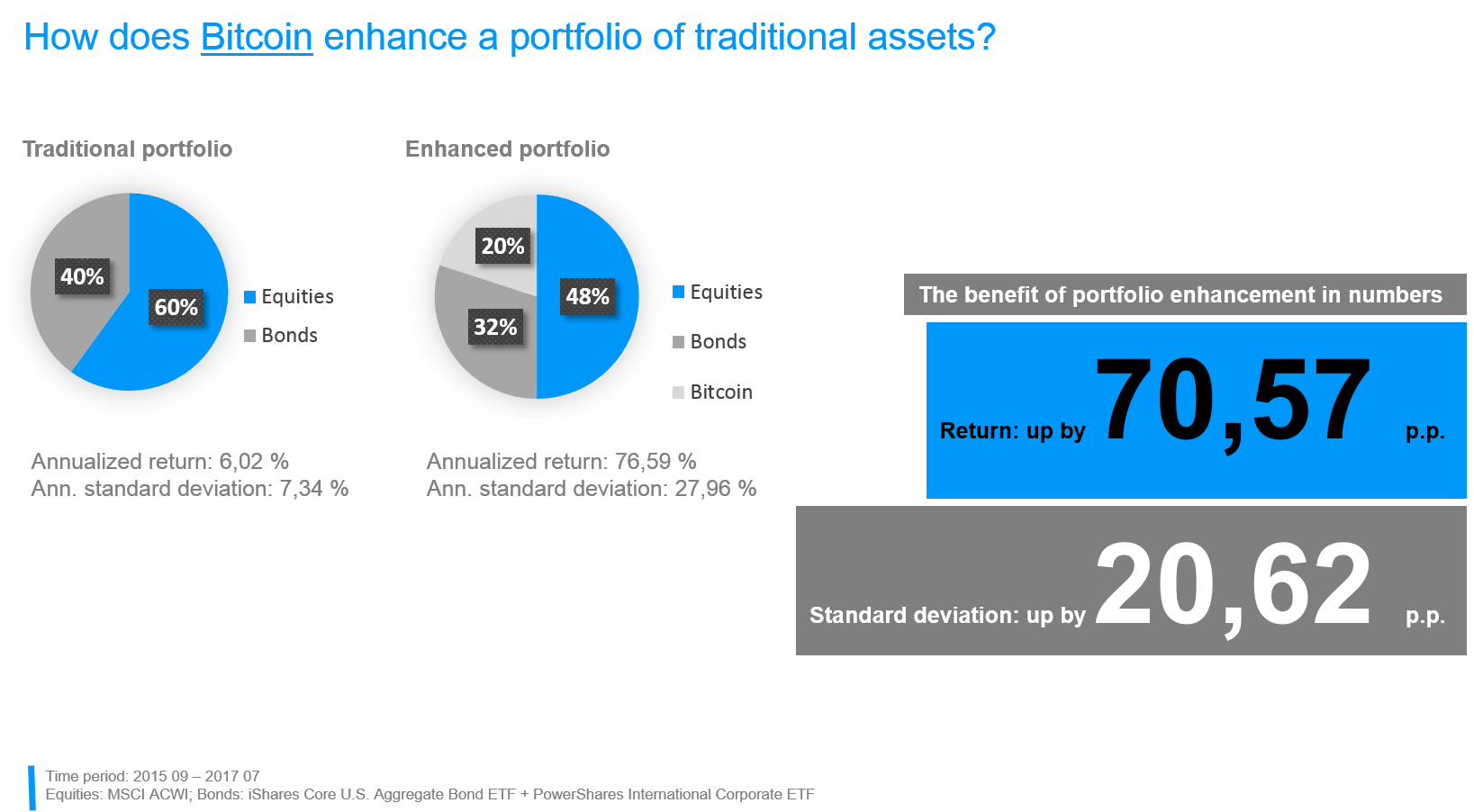

Sounds catchy already? Wait a moment. If you feel like a gold or some carefully selected hedge funds are “old fashioned” safe havens for your portfolio and not “cool” anymore, you can always make a step further and allocate some of your funds to hot and sexy assets like crypto currencies or bitcoin. Take a look at how traditional portfolio could look like if you were smart (and brave!) enough to jump into crypto currency market back in 2015. Some markets experts are even saying it might not be too late, as the tide is still strong and bitcoin might be the best asset going forward!

We do agree, the time period is too short and the bitcoin itself is too hot recently with quite many unknowns (even unknown yet!) to take it seriously as a mean for a perfect hedge however it's up to each investor to decide which eggs to add to a basket.

To sum everything up, we agree that everyone should relook his portfolio, however, gold is neither the only one nor the best option. Gold is still viewed as a safe haven asset that investors flock to during periods of uncertainty. Amid this renewed flare-up in tensions with North Korea, Capital Economics took a look at how the precious metal has responded to geopolitical risk events since 1985. What the research firm found might surprise you:

According to analyst Simona Gambarini, the price of gold "tends to rise in anticipation of a conflict but often falls when tensions turn into a full-blown war."

Gold is not the one or the only anymore as safety can be found in some emerging asset classes as well. Should you are interested to learn more, get in touch to find out more about our alternative investments research, due diligence and selection services and the value hedge funds could add to your traditional portfolio.

Be well invested.

Disclaimer

This publication is for general information only. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Past performance is no guarantee for future results. You should note that high performance targets can only be achieved by accepting higher risk of the portfolio. Where included in this document, benchmarks and index data provided are for illustrative purposes only. The portfolio / strategy mentioned does not formally track any such benchmarks or indices and no representation is made as to relative future performance or tracking deviation. In some circumstances it may be difficult for the investor to sell or realize such investments or obtain reliable information about their value. The investments discussed may not be suitable for all investors. Before committing to an investment, you should seek for the professional investment, legal, tax or accounting advise. All information provided in this publication is considered reliable. In the event of changing market circumstances MC Investments will not be held responsible for any damages experienced by investors.